Baseline Configuration

One of the most important configuration settings is the bounds on the baseline prior. The baseline prior controls the number of conversions (or amount of revenue) attributable strictly to organic conversions (absent marketing spend, promotional spikes, holidays, etc). We typically control this prior by setting three percentages: low-medium-high. These percentages are translated into strict prior bounds by doing the following:

-

Calculate the median dependent variable for the previous 30 days before the as of date

-

Multiplying the median by the lower and upper percentage

-

A simulation is performed to ensure the mean of the prior distribution is approximately equal to the median dependent variable * the medium percentage

Recast has more advanced methods for setting baseline priors, including priors that vary over time, but our default configuration uses a flat prior range over all timesteps.

Channel-Level Configuration

Upper Funnel vs Lower Funnel Channels

The first thing to decide about each marketing channel is whether it should be classified as an upper funnel channel or a lower funnel channel. Lower funnel channels are typically affiliate or paid search, where the amount paid is directly related to the sale event. When something is marked as a lower funnel channel, Recast will treat it special in a few ways:

-

Treat spend as an outcome, not just an input. This means that Recast will estimate a relationship between upper funnel spend and lower funnel spend. For example, we may estimate that for every $1k rise in TV, affiliate spend increases an extra $100 on average. We then use this information in forecasts, where the user only has to provide TV spend and we predict affiliate spend.

-

Reapportion credit to show a proper “total ROI” for upper funnel channels. The total ROI (shown on the Last Week Snapshot and whenever you select “Include lower funnel effects”) calculates the direct contribution of the channel, as well as the additional contribution from increasing spend in lower funnel channels, which then generate their own sales.

-

By default, lower funnel channels are excluded from time shift. Although override-able, this is the proper setting if the spend happens on the same day as conversion, such as when an affiliate program pays out whenever someone purchases.

-

By default, lower funnel channels are excluded from saturation. Although override-able, lower funnel channels are excluded from saturation by default because an increase in spend in something like affiliate (that may be juiced by upper funnel spend) should not see diminishing returns of incrementality.

ROI settings

ROI prior configuration

We specify a prior on the ROI by specifying a range that the ROI (or CPA) can be in at a particular price point, defined by the “Spend Level” column. At higher price points the prior on the ROI will be lower, on lower price points the prior on the ROI will be higher. These ROI/CPA priors can be set arbitrarily, but we recommend a pattern for getting to a reasonable starting point for the priors. Internally we call it “napkin math.”

You can make a copy of our Napkin Math Template to try it on your own.

The logic of the napkin math works like this:

-

First, calculate the base CPA (or ROI) over a wide time period (all dollars spent divided by all conversions in the last two years).

-

Then choose your intercept percentage assumptions (what % of your conversions are driven organically?) either by choosing one of our starting ranges, or building your own.

-

By dividing the base CPA by 1-intercept percentage, we get the average CPA across all channels, if that was the true intercept percentage.

-

Then we spread these into a range by assuming that some channels at some points in time will be 3x worse than the average channel, while some channels at some points in time will be 3x better than the average.

-

As one final edit, we recently started dramatically raising the upper bound CPA and setting the lower bound ROI prior to 0. We have found this better aligns with clients' incrementality tests (showing no lift at all) and their belief that some money is totally wasted.

-

-

We then take the range of these possibilities to get the range to use as our CPA prior.

We generally take the approach of applying the same ROI prior to all channels in the model. While true prior beliefs may vary about specific channels, we’ve found that in general tweaking priors to match customer expectations leads to a conflict where customers worry that we’re just engraining their own biases into the model. By using identical priors, we can be more confident that the posterior estimates are truly differentiated by data and not by different priors.

Exclude from saturation

We model the diminishing returns of a channel using the hill function (see our website for a introductory explainer). However, we also allow a channel to be excluded from saturating altogether, meaning that the estimated ROI will apply regardless of how much money is spent in the channel. This can be a useful assumption for lower funnel channels or channels where the diminishing returns are not expected until far greater levels of spend than are currently expected to be reached.

Spend Level (Saturation Priors)

We don’t typically specify priors on the parameters that control how fast the channel saturates. Instead we use the “Spend Level” to indicate at what dollar amount the ROI prior should apply. We then do a simulation to find a prior on the saturation that allows for the possibility that the channel is very saturated at the “spend level” or very unsaturated at the “spend level.” If you find the model is expecting too much saturation, raising the “spend level” will lower the expected saturation and vice versa. As a starting point, you can either set the “spend level” at the channel’s recent median spend, or if you know the channel is not close to being saturated, you can set it at the level of spend you think the channel could reasonably scale to.

Non-Spend channels

In general, Recast usually recommends sticking to spend channels for predictor variables. However, our model can also incorporate non-spend predictors, like emails sent. These channels are not optimizable because they don't "compete" with other channels in the model for dollars; however, they can be used in forecasting. All other priors regarding predictor variables are still applicable, but special care should be taken in order to set reasonable ROI priors. While a 1x return on every dollar spent in Facebook may be reasonable, a $1 return for every email sent to a customer list is probably not.

Shift Settings

Shift prior configuration

For each channel, Recast estimates a shift curve to model the ad stock effect. This shift curve is constant across time, but different for each channel. The inputs to determine the shift curve are how many days it could reasonably take for 95% of the effect of spend to have been realized. We ask for a low-mid-high range of where this effect could be, and then back into the negative binomial parameters we use to parameterize the shift curve.

A low-mid-high range of 2, 7, and 31 means that our shift curve at it’s shortest could look like the green curve above (with over 60% of the effect happening on Day 0) and at it’s longest could look like the blue curve above (with about 10% of the effect happening on Day 0, and slowly petering out over time).

Exclude from shift

A channel can be excluded from shift, meaning that the full effect of the spend is realized on the day the money is spent.

Shift Concentration

The concentration parameter controls how right skewed the effect of spend is in the shift curve. If the concentration parameter is less than 1, the mode of the distribution (the day with the biggest effect) is Day 0. If the concentration parameter is greater than 1, the mode will be after Day 0.

For most channels, our opinion is that we should put strong prior weight on the channel having it’s mode close to Day 0. To this end, our default prior is a lower bound of 0.2 and an upper bound of 3.

Certain channels, however, can reasonably have a mode greater than 0. This can happen if there are two types of lag at play: a distribution lag and an adstock effect. For example, with direct mail, we typically record the spend on the day the mail goes to the post office. It will then take a few days for the mail to get distributed before the adstock effect takes effect. Podcasts can have a similar effect. For these channels we typically default to a concentration prior lower bound of 0.5 and upper bound of 10.

In the prior setting code, we support the following ConcentrationSetting options that set particular bounds on the Concentration parameter:

-

1 - this sets a lower bound of 0.2 and an upper bound of 1, for cases where there is no probability that the mode of the effect is greater than 0.

-

3 - this sets a lower bound of 0.2 and an upper bound of 3, our default prior for most channels

-

10 - this sets a lower bound of 0.5 and an upper bound of 10 (mean 3.5), our default prior for channels where we expect distribution lag (like mail and podcast)

Spike Configuration

There are two types of spikes available in Recast:

-

Additive spikes - these spikes model changes in the dependent variable directly. They’re called “additive” because they directly add to (or subtract from) the predicted dependent variable.

-

Saturation Spikes - these spikes change the saturation multiplier, which multiplicatively effects the saturation point across all marketing channels. A saturation spike will make channels less saturated.

For convenience a spike can be marked as additive and saturation, although we treat these as two separate things within the model.

Additive spikes are typically used for promos and holidays where the dependent variable changes rapidly.

Saturation spikes are usually used around holidays, where the number of people in the market for a particular good rises quickly, thus making marketing more effective.

To configure a spike we need the following pieces of information:

-

Spike group — each spike belongs to a group. The group is constructed using a Bayesian hierarchical model so that in the absence of data (like a spike in the future) the predicted performance will be similar to the in-sample spikes in the same group.

-

Additive spike - Boolean - whether it’s an additive spike

-

Saturation Spike - Boolean - whether it’s a saturation spike

-

Main Date - The main date of the spike. Spikes can effect 30 days before and after the “Main date.” Their largest effect will be around the main date, while pull forward and pull backward effects of promotions will be included in the surrounding days. Typically we set the main date as the date in the promotional/holiday period with the highest sales.

Incrementality Tests

All details about how to configure incrementality tests can be found on the Experiments page.

Contextual Variable Configuration

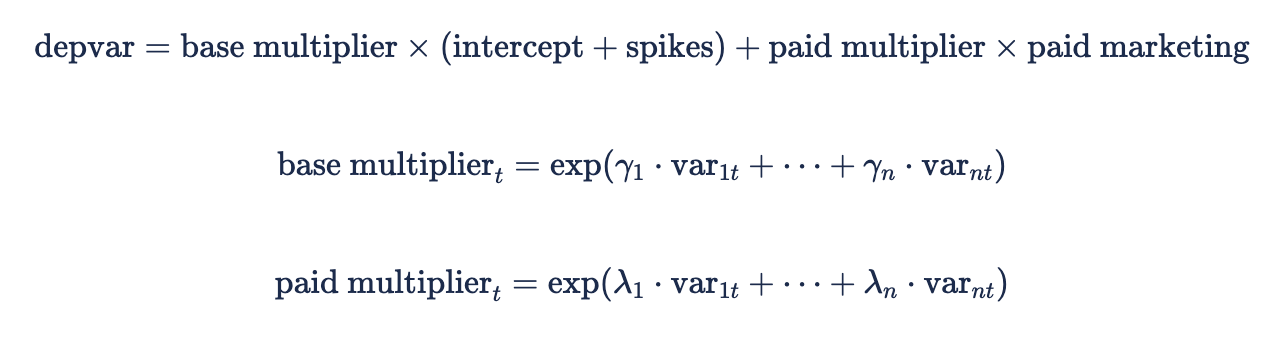

Contextual variables are variables that indirectly effect the dependent variable by changing the organic effectiveness and the effectiveness of marketing. A classic example is when a company raises prices. The number of conversions will likely fall, and this fall will be attributable to a drop in the number of organic conversions, as well as less efficient marketing spend (as customers are turned off by the price point). Instead of attributing conversions to this variable directly, we model a multiplicative effect on the intercept/spikes and ROIs. We can shorthand the equations as:

The above equation says that the base multiplier at time t is the exponentiated sum of each contextual variable at time t multiplied with the estimated contextual variable effect gamma. If we believe the contextual variable should affect only the base or the paid, we can make this a constraint by setting the “Effects Type” setting to “Base only” or “Paid only”

This model assumes that the context variable has the same multiplicative effect on all channels ROIs.

In order to configure a contextual variable, you supply it as a column in clean_data and then specify it on the ContextVariables tab during prior setting. The app automatically supports three common types of transformations you might want to do on the contextual variables. This means that you can supply the variables without applying the transformations, and when someone uses the app to run forecasts/optimizations they can supply the variable in the natural units they’re used to that will then be automatically translated to the modeled units behind the scene.

The three transformations are:

-

Logging - take the natural log of the contextual variable (see below for how this changes the interpretation).

-

Smooth - applies a smoothing operation to the dependent variable (ensuring the day to day variation isn’t too jumpy), two types:

-

Rolling mean - take a rolling mean, the alignment (center, left, or right) and the window size are configurable

-

Loess smoothing - the span parameter is configurable

-

-

Scaling - Dividing by a constant in order to make the range appropriate for the prior (which does not change). Larger scaling factors correspond to smaller priors.

Interpretations

When logging, the interpretation is: an x% change in the context variable has a y% change on the marketing (or organic) effectiveness

When not logging, the interpretation is: an x unit change in the context variable has a y% change on the marketing (or organic) effectiveness

The smoothing operation does not change the basic interpretation, although it will change how reactive the model is to the change in contextual variable.

Scaling

Scaling the context variable is important because we use a constant prior N(0, 1) on all the effects.

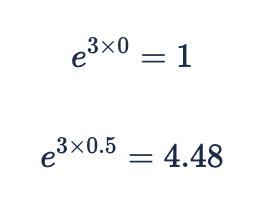

A baseline recommendation (which can be customized for specific cases) is to scale the data such that there is roughly a 0.5 range from the min to the max of the data. If we take 3 as a large, but not impossible posterior mean from a standard normal prior, this means at the two extremes of the data we will have:

In other words, marketing (or organic) effectiveness will be 4.48x higher at the peak of the context variable than at the lowest point. The larger the range of the data, the bigger the prior difference in multipliers from the top of the scale to the bottom.

Note: in order to figure out the proper scale, you must take the log first if you are logging. While it may seem it would be convenient to set the ending range you want in directly in the prior inputs (for example, use whatever scaling factor gives a 0.5 range), this is not ideal because it is equivalent to calculating the prior from the data, which will lead to changing priors every time the range of the observed data changes.

Non-modeled Settings

There are two additional parameters that are configurable in the Google Sheet/Airtable, which do not change the model, but customize how we display the results in the dashboard.

Unit Type defines how we customize the units in the interpretation text provided in the contextual variable summary. There are five options currently:

-

Percentage - the only acceptable option if logging the depvar (an error will throw if Percentage is not used when logging). When using Percentage, the Reference Unit refers to the percentage increase you want to use to demonstrate the effect. If it’s 0.1, the interpretative sentence will be “For every 10% increase in context var, the marketing effectiveness will change by ….”

-

Units - When the context variable refers strictly to a count of something

-

Currency - when the context variable refers to a monetary amount. The text will be formatted with the proper currency symbols.

-

PercentagePoint - when the context variable refers to a percentage, as in brand awareness surveys. This assumes the raw variable is in the interval [0-1]

-

Binary - when the context variable refers to an on or off state, like a one time price increase.

Reference Unit allows you to customize the sentence because the traditional statistical interpretation (”a one unit increase in x leads to a …”) may not be helpful if the units are measured in millions or hundredths. It should be selected to be whatever a normal, meaningful change in the context variable would be to the client (on the client’s scale, not the transformed scale). When Unit Type is binary, it should always be 1.

Context Variables and Budgets

Currently goals, optimizations, and forecasts can handle context variables in two ways:

-

User does not provide — in this case, the last value in the in-sample data is carried forward for the out of sample data. In many cases this might be our “best guess” of what the future holds.

-

Clients provide the data in the format they originally provided the data. The three transformations will happen automatically by the app.

Other Parameters

Our model supports a number of advanced settings that give deep control over model features. We generally call these the “other parameters”.

These other parameters have a wide range of uses, from enabling/disabling entire model components to turning on/off specific bug fixes in the model code.

This list of otherparams is by no means exhaustive and will continue to grow as we expose more of these to our model's users.

Note: Recast Operators cannot currently directly edit these parameters, but they can be edited for your models by a Recast employee.

OtherParams related to model features

-

use_spike_only_k_seasonal_multiplier- This enables or disables the time-varying saturation multiplier that is shared between all saturating channels. If this is set to 1 then the shared saturation multiplier is just1 + saturation_spikes. If this is set to 0 then the shared saturation multiplier has the formtime_varying_part + saturation_spikes, wheretime_varying_partis a Gaussian process that uses the same kernel as the intercept and betas. This defaults to 1 for new models.

OtherParams related to likelihoods

-

lower_funnel_likelihood_multiplier- This controls the weight of the lower funnel likelihoods in the posterior. Generally we want the lower funnel likelihoods to carry less weight than the depvar likelihood. This defaults to 0.6 for new models.

OtherParams related to priors

-

k_mult_lbandk_mult_ub- These control the upper and lower bounds of the time-varying saturation multiplier, if it’s enabled. These are set on the log scale, so thatlog(b)corresponds to a boundbon the time-varying saturation multiplier. These default tolog(0.2)andlog(5), respectively, for new models.

OtherParams related to stacking

-

stacking_alpha- When stacking across models using different kernels, we apply a Dirichlet prior to the kernel weights. Thisstacking_alphais the alpha parameter in that Dirichlet distribution. Higher values here nudge the kernel weights closer together. This defaults to 5 for new models. -

use_multi_model_stacking_weights- This setting uses the last ten public deployments of the model to determine the kernel weights of the new run. Rather than basing the kernel weights only on each kernel’s 30-day backtest, we now incorporate each kernel’s last ten 30-day backtests in the calculation. Considering multiple 30-day backtests like this reduces the noise in the estimate of each kernel’s predictive power and, consequently, produces more stable kernel weights from week to week. This should improve overall model stability. This defaults to on for new models.